How Healthy is Your Cashflow? Get Your Business Ready for the Holiday Period

The shift into the New Year is a time when many businesses are vulnerable, but it doesn't have to be. We know you’ve been crazy busy all year long, and the holiday season is a well deserved break for your team - but unfortunately, overheads and bills don't pause.

For many Kiwi businesses, the slowdown in project work during December translates to lower cash flow hitting the bank in the New Year. To top it all off, the squeeze often happens right when the Provisional Tax deadline hits in mid January.

Our mission at Bizzy is to help businesses navigate cashflow and provide better access to finance to grow their business. This is why we want to share resources and tools to help business owners prepare.

For this article, we talked to tax and finance expert Baqir Hussain, who helps Kiwi businesses manage cashflow and tax and runs Finex Accounting. He warns that "Every year, January catches people out."

Smart businesses use the time now to plan ahead so you can start the new year ready to grow. To help get you started, we’ll also be sharing our own cashflow template we use ourselves at Bizzy - so keep reading.

How Different Industries Are Affected

Preparing Your Business Cashflow For The Holiday Period

Smart business owners are actively looking ahead and asking: how's our cashflow looking from now until the end of March? But even beyond the forecast, there are many things business owners can do to prepare for the holiday season and mitigate cashflow risks for the business.

Baqir shares his practical four steps that business owners can use to prepare for the holiday season and upcoming tax dates:

Put money aside regularly throughout the year, so you’re not relying on December cashflow to cover a mid-January tax hit.

Use a separate tax account or tax pooling service can smooth out the pressure and avoid interest or penalties from IRD.

Assess whether you need to adjust the payment if your profitability has changed.

If you’re expected to be short on funds, apply for temporary short-term funding to make up for the difference.

Key Dates After the Holidays Business Owners Need To be Aware Of

One of the biggest surprises to business owners are the tax payment dates that come up pretty quickly after the holidays. These are important to include in your forecasts so you can minimise impact on your businesses.

Keep an eye out for the following key dates:

15 January: Provisional Tax (second payment for most businesses)

7 February: End-of-year income tax payment due (or 7 April if you have a tax agent)

28 February: GST (for the December/January period)

31 March: Financial year end for the majority of NZ businesses

7 May: Last provisional tax payment (third payment for most businesses)

These payments often come when cashflow is tight for many businesses and projects are still getting back into gear after the break. Planning ahead now ensures you can meet your obligations without stress or penalties.

Getting Started: The Cashflow Forecast Template

But even outside of the holiday period, every business needs a rolling 3 month cashflow plan. Baqir recommends to look ahead - not just at your sales, but when the money will actually hit your account. A good forecast lets you see any dips early and make smarter calls, whether this means tightening expenses, chasing due payments, or lining up funding before it becomes an emergency.

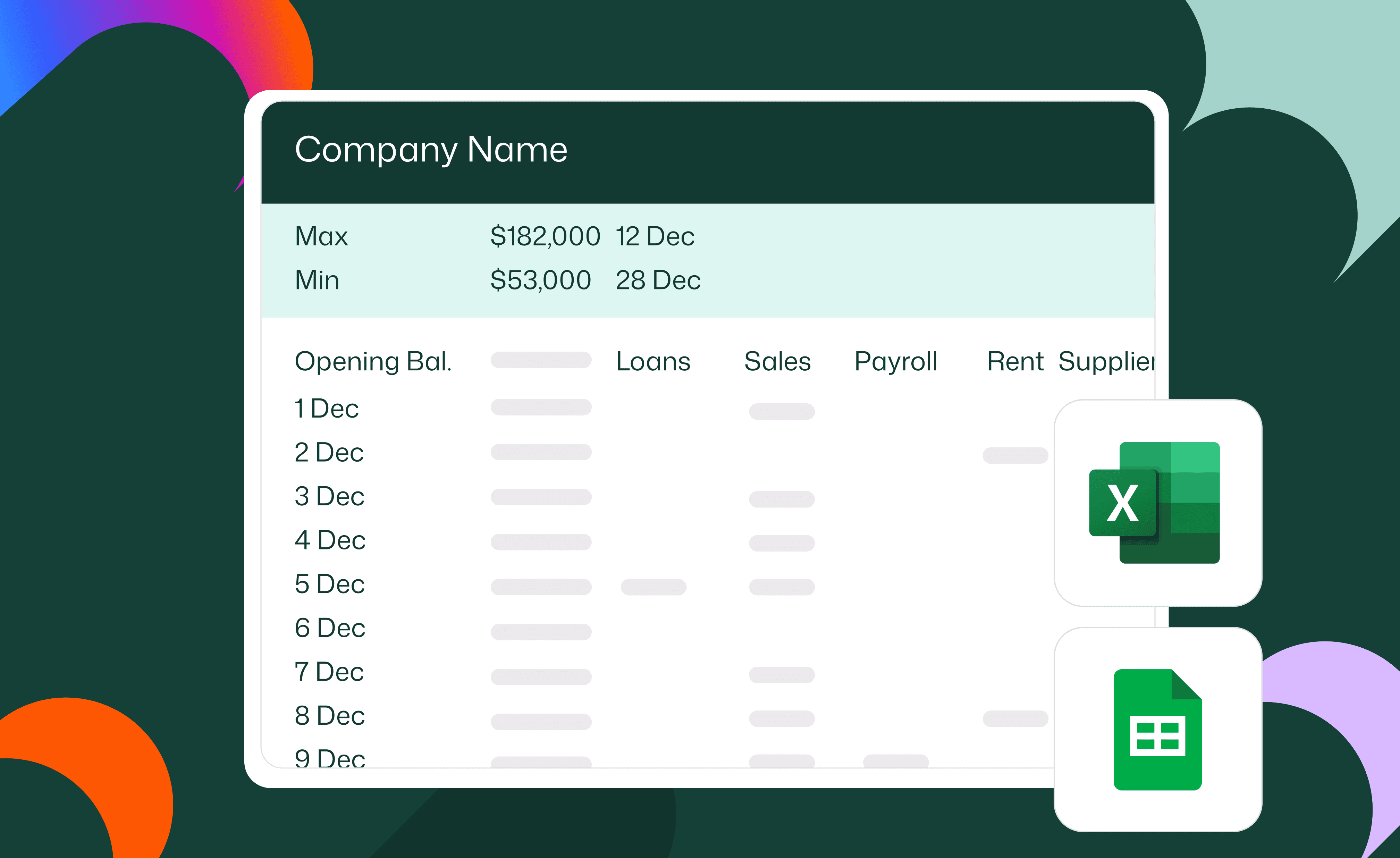

At Bizzy, we implemented a new 3 month forecast earlier this year, and it’s been a game changer that allows us to plan ahead and course correct where needed. We thought we’ll share the exact Cashflow Forecast Template we use at Bizzy - created by one of our trusted finance partners and refined over the last 5+ years with feedback from dozens of Kiwi businesses.

You can use the template to:

Enter in your incomings and outgoings for the upcoming months

Easily view your balance until March 2026

Plan your 3 month cashflow ahead throughout the year

Look out three months ahead, identify your pinch points and get prepared. As Baqir shared: "Planning and discipline makes all the difference. Don't bury your head in the sand."

Get started forecasting for your business with our free Bizzy Cashflow Template:

Want to explore funding options for your business?

Bizzy is free to use for businesses - browse multiple quotes with only one application, all in one place.